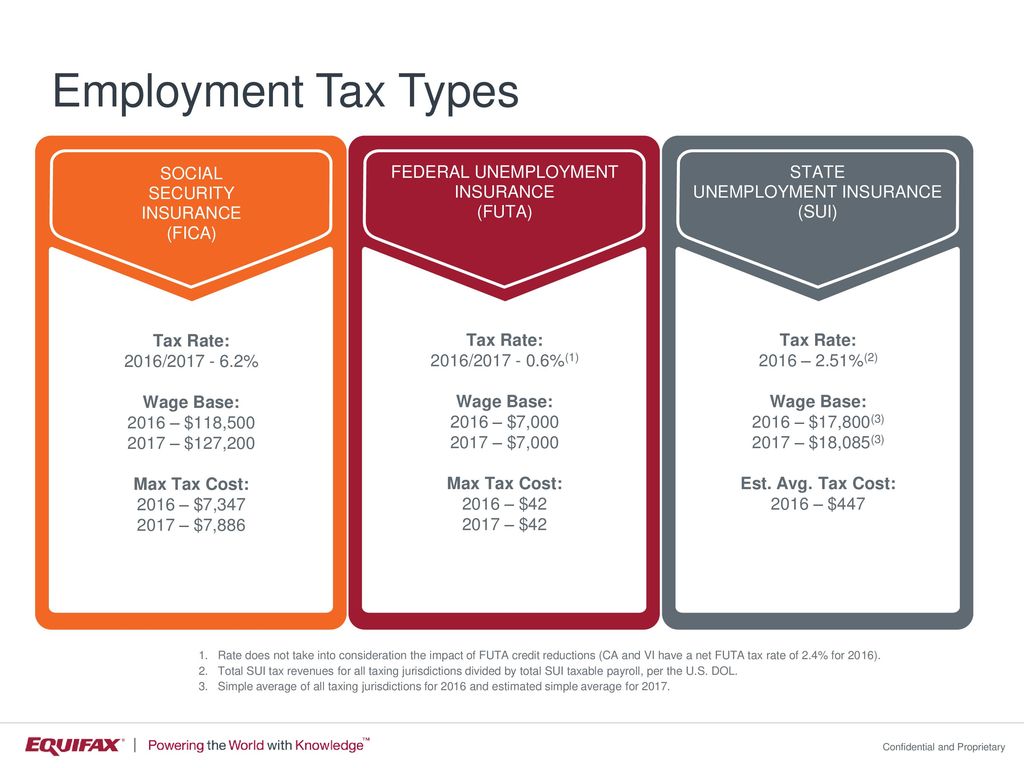

Unemployment Compensation: The Fundamentals of the Federal Unemployment Tax (FUTA) - EveryCRSReport.com

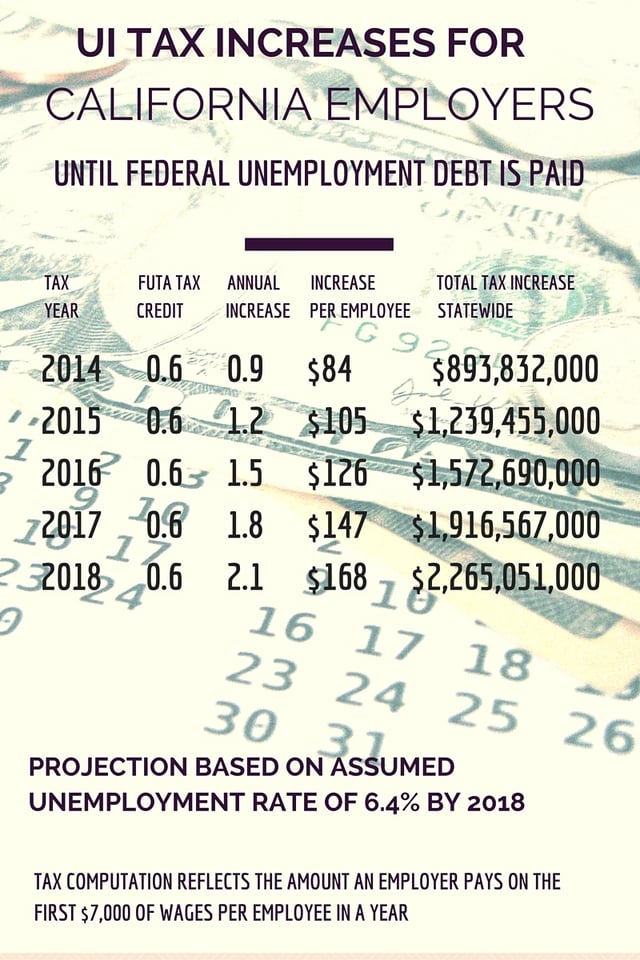

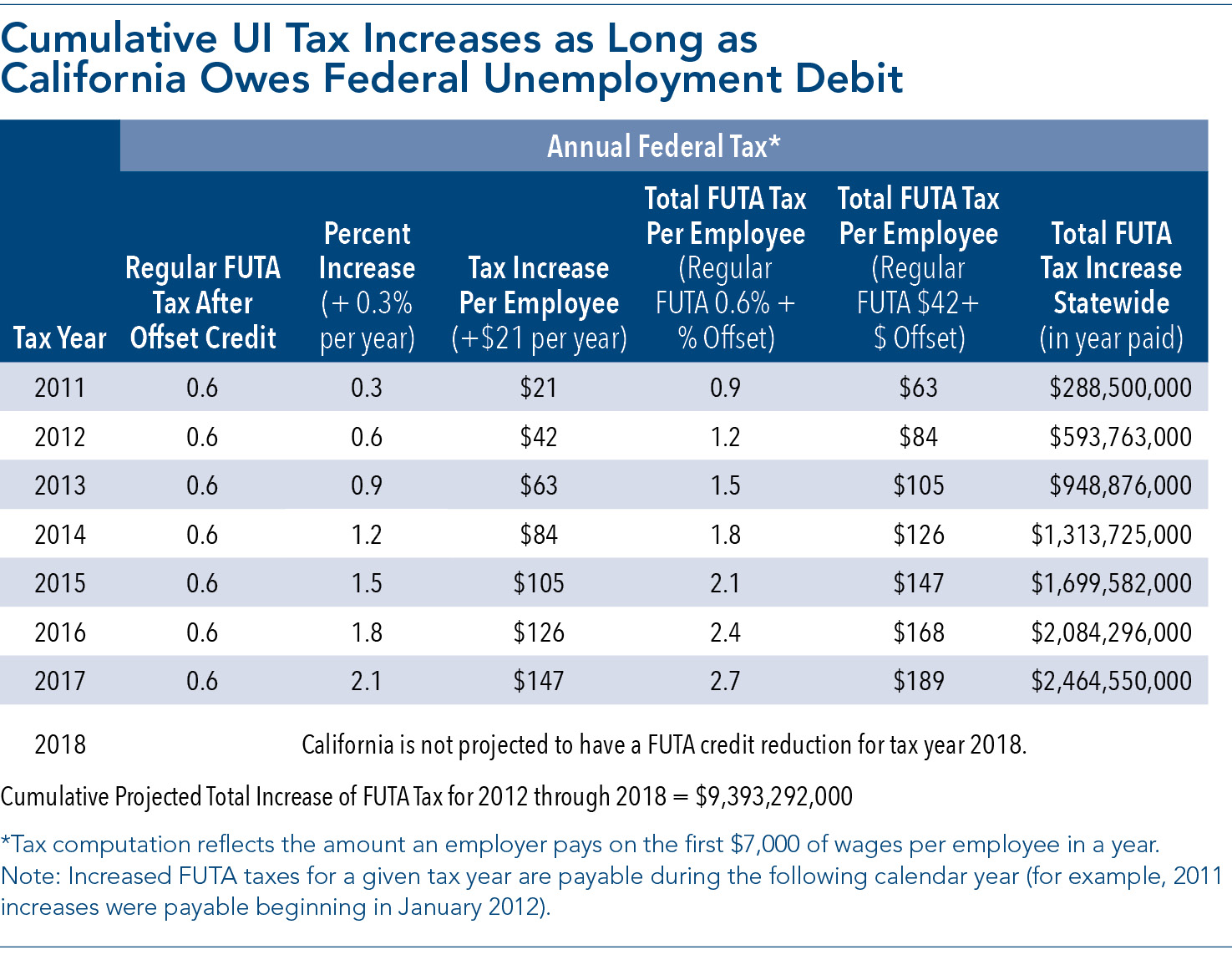

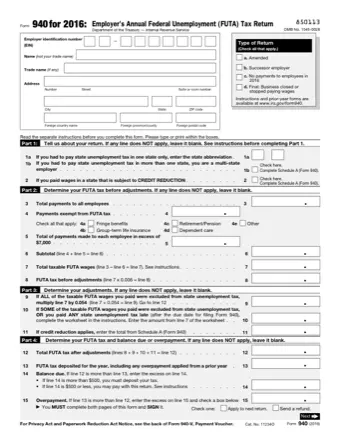

Note: For this textbook edition the rate 0.6% was used for the FUTA tax rate for employers. The following unemployment tax rate schedule is in effect for the calendar year 2015 in